Us Crypto Coins Shaping The Financial Landscape

With us crypto coins taking the spotlight, we are standing at the edge of a financial revolution that is reshaping how we view currency, investments, and technology. As these digital assets gain momentum, their significance in the US financial market continues to grow, drawing attention from both seasoned investors and newcomers alike.

From the historical development of crypto coins to their current prominence, this exploration offers insights into popular coins, regulatory environments, investment opportunities, and the technological innovations that are setting the stage for the future of finance.

Overview of US Crypto Coins

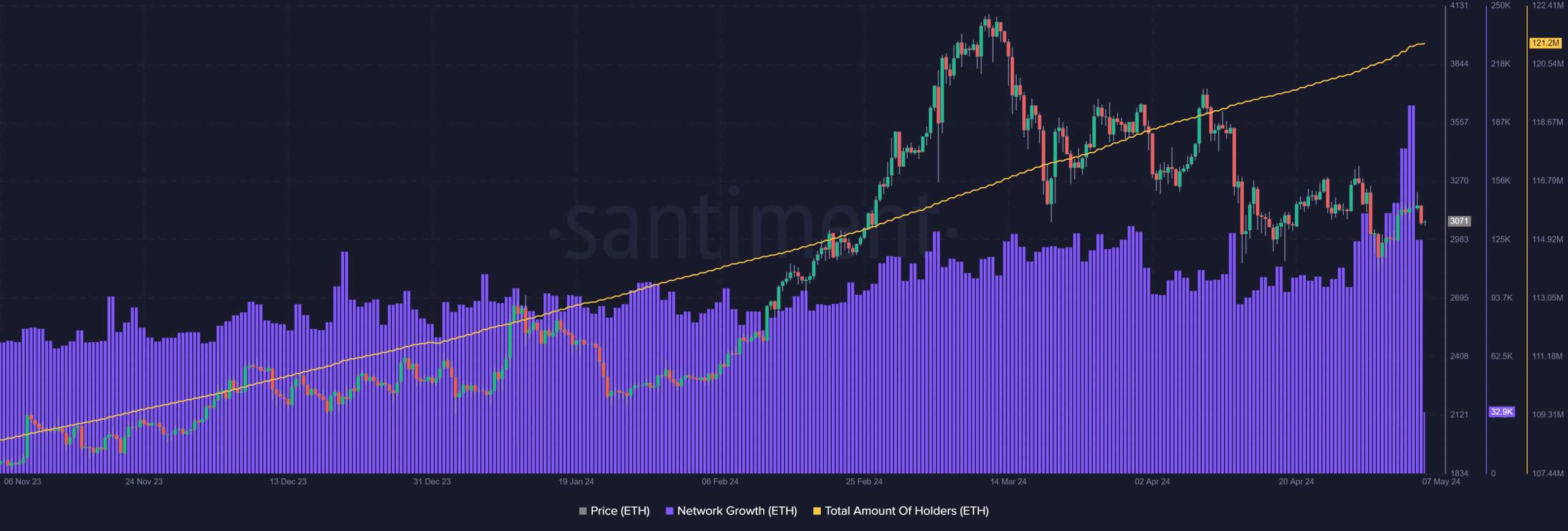

The emergence of cryptocurrency has revolutionized the financial landscape in the United States, introducing new opportunities and challenges alike. Crypto coins are digital assets built on blockchain technology, and their significance in the US financial market cannot be overstated. They offer a decentralized alternative to traditional currencies and have gained traction among investors and businesses.Among the most popular US crypto coins are Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB), each boasting substantial market capitalizations.

As of October 2023, Bitcoin remains the leader, with a market cap exceeding $800 billion, followed closely by Ethereum at approximately $400 billion and Binance Coin at around $60 billion. The historical development of crypto coins in the US has seen several phases, including the initial skepticism from regulators and the gradual acceptance as public awareness and investment interest surged.

This evolution has significantly impacted the economy, driving innovation, investment, and new business models.

Regulatory Environment

The regulatory environment surrounding crypto coins in the US is complex and constantly evolving. Currently, federal agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) oversee various aspects of cryptocurrency regulation. Additionally, states have their own specific regulations that can differ widely. For example, New York has enacted the BitLicense framework, while Texas has taken a more lenient approach, allowing for broader adoption.Key regulatory bodies involve:

- The SEC, which focuses on securities laws and investor protection.

- The CFTC, which oversees derivatives and futures contracts related to cryptocurrencies.

- The Financial Crimes Enforcement Network (FinCEN), responsible for anti-money laundering (AML) compliance.

Investment Opportunities

Investing in US crypto coins presents numerous potential benefits, such as diversification of investment portfolios and the possibility of high returns. Despite the volatile nature of the cryptocurrency market, historical data shows significant returns for early investors. Here’s a table comparing the returns of various US crypto coins over the last five years:

| Crypto Coin | 5-Year Return (%) |

|---|---|

| Bitcoin (BTC) | 400% |

| Ethereum (ETH) | 600% |

| Litecoin (LTC) | 250% |

Effective risk management strategies are essential for investors in crypto coins. Techniques such as diversification, setting stop-loss orders, and staying informed about market trends can help mitigate risks associated with this volatile asset class.

Technological Innovations

The technology underpinning popular US crypto coins primarily revolves around blockchain, a decentralized ledger that ensures transparency and security in transactions. Innovations such as smart contracts on platforms like Ethereum have further enhanced the utility of cryptocurrencies. These self-executing contracts automatically enforce the terms of an agreement, reducing the need for intermediaries.Advancements in technology are reshaping the future of crypto coins in the US by enabling faster transaction speeds, lower costs, and enhanced security features.

As the technology matures, we can expect increased adoption across various sectors.

Market Trends and Predictions

Current market trends indicate a growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs), which are becoming increasingly popular in the US. Experts predict that crypto coins will continue to gain mainstream acceptance over the next decade, driven by technological advancements and broader financial inclusion.Global economic factors, such as inflation and changes in monetary policy, significantly influence the US crypto coin market.

As traditional financial systems face challenges, cryptocurrencies are likely to emerge as viable alternatives.

Use Cases and Adoption

US crypto coins find various applications, including payments, remittances, and investments. Their ability to facilitate quick and low-cost transactions makes them appealing to consumers and businesses alike. One notable case study involves a popular online retailer that adopted Bitcoin as a payment method, resulting in increased sales and customer engagement. Factors influencing the adoption of crypto coins include consumer awareness, regulatory clarity, and technological accessibility.

Challenges and Risks

Investors in US crypto coins often face common challenges, such as market volatility, regulatory uncertainty, and security risks. The rapid price fluctuations can lead to significant financial losses if not properly managed.To mitigate these risks, investors are encouraged to adopt prudent investment strategies and stay vigilant about security concerns. Best practices for safe transactions include using reputable exchanges, securing private keys, and enabling two-factor authentication.

Community and Culture

Online communities play a vital role in supporting US crypto coins, providing platforms for knowledge sharing, networking, and collaboration. Prominent events such as the Consensus Conference and the North American Bitcoin Conference foster connections among enthusiasts and professionals in the crypto space.The cultural impact of crypto coins is significant, particularly among younger generations who are more inclined towards digital assets.

This engagement influences societal perceptions of money and finance, prompting discussions about financial sovereignty and decentralization.

Conclusion

In conclusion, the journey of us crypto coins is more than just a financial trend; it represents a transformative era in how we engage with money and technology. As we navigate the challenges and opportunities that lie ahead, the future of crypto coins in the US holds promise for innovation, investment, and a shift in economic paradigms.

Query Resolution

What are the most popular us crypto coins?

The most popular us crypto coins include Bitcoin, Ethereum, and Binance Coin, known for their substantial market capitalizations and widespread adoption.

How does regulation affect us crypto coins?

Regulation varies by state, influencing how us crypto coins can be used and adopted, with some states being more favorable than others.

What are the risks associated with investing in us crypto coins?

Common risks include market volatility, regulatory changes, and security concerns, which can impact investment values significantly.

Can businesses accept us crypto coins as payment?

Yes, many businesses now accept us crypto coins for payments, making it easier for consumers to use their digital assets in everyday transactions.

What is blockchain technology?

Blockchain technology is the backbone of cryptocurrency, ensuring secure and transparent transactions by storing information in a decentralized manner.