Bitcoin Ethereum Solana Prognose Insights And Trends

With bitcoin ethereum solana prognose at the forefront, this exploration takes you on a journey through the evolving landscape of these leading cryptocurrencies. Each has its unique characteristics, potential, and challenges that shape their roles in the market. Whether you're a seasoned investor or just curious, understanding their dynamics can offer valuable insights into the future of digital currencies.

In this overview, we'll delve into the foundational aspects of Bitcoin, Ethereum, and Solana, highlighting their differences and historical development. We'll analyze recent market trends, technological innovations, and investment potential, providing a comprehensive look at what lies ahead for these digital assets.

Overview of Bitcoin, Ethereum, and Solana

The world of cryptocurrencies has been revolutionized by three key players: Bitcoin, Ethereum, and Solana. Each of these digital currencies has laid its own foundation, contributing uniquely to the crypto space. Bitcoin, launched in 2009, was the first cryptocurrency and introduced the concept of decentralization using blockchain technology. Ethereum followed in 2015, expanding the blockchain's use beyond currency to include smart contracts, which allow developers to create decentralized applications (dApps).

Solana, emerging in 2020, aimed to solve scalability issues and introduced a high-speed, low-cost transaction framework.Bitcoin primarily serves as a digital store of value and a medium of exchange, while Ethereum's platform enables developers to build applications and execute smart contracts. Solana stands out for its rapid transaction speeds and lower fees, making it appealing for various applications, including decentralized finance (DeFi) and non-fungible tokens (NFTs).

The development history of these cryptocurrencies highlights their evolution: Bitcoin's initial use as an alternative currency, Ethereum's rise with dApps, and Solana's innovative approach to scalability.

Market Trends and Performance

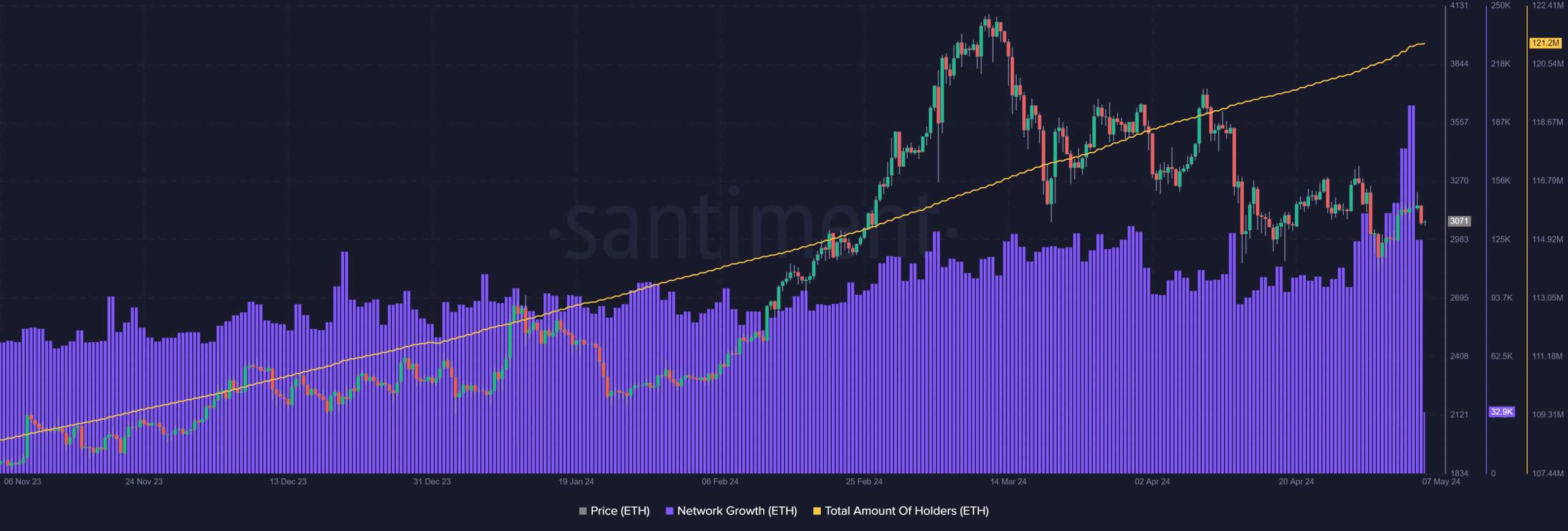

Recent market trends show volatility among Bitcoin, Ethereum, and Solana, influenced by macroeconomic factors, regulatory developments, and technological advancements. Over the past year, Bitcoin has remained the market leader, often seen as a safe haven amidst uncertainty, while Ethereum has gained traction due to its robust NFT and DeFi ecosystem. Solana, although newer, has captured attention with its performance, often outperforming Ethereum in transaction speed and costs.Statistical data reveals that Bitcoin's price fluctuated between $30,000 to $70,000, Ethereum saw movements from $2,000 to $5,000, and Solana ranged from $30 to $100.

Factors influencing these performance trends include market sentiment, institutional investments, and advancements in blockchain technology.

Technological Features and Innovations

Bitcoin, being the first cryptocurrency, introduced a secure and decentralized monetary system. Its primary technological feature is the proof-of-work consensus mechanism, which, while effective, can result in slower transaction speeds. Ethereum revolutionized this by introducing smart contracts, which automate contract execution without intermediaries, enhancing trust and efficiency. Solana further innovated by implementing a unique proof-of-history (PoH) mechanism, allowing it to process thousands of transactions per second.These technological differences significantly impact each cryptocurrency's application.

Ethereum’s smart contracts enable a wide range of decentralized applications, while Solana's scalability solutions make it ideal for high-throughput applications. Bitcoin’s simpler structure makes it resilient but less flexible compared to its counterparts.

Investment Potential and Risks

The investment potential of Bitcoin, Ethereum, and Solana varies significantly. Bitcoin is often viewed as "digital gold," a hedge against inflation, while Ethereum offers substantial potential due to its foundational role in the DeFi space. Solana attracts investors looking for high growth potential due to its innovative technology and scalability.However, investing in cryptocurrencies comes with inherent risks. Bitcoin's market can be influenced by regulatory changes, Ethereum faces competition from other smart contract platforms, and Solana's rapid growth has raised concerns about its long-term sustainability.

Long-term strategies for Bitcoin may focus on holding, while Ethereum investors may look for project-specific developments. Solana, being newer, may appeal to those seeking short-term gains.

Predictions and Future Outlook

The future outlook for Bitcoin, Ethereum, and Solana appears promising, with potential growth driven by increased adoption and technological updates. Predictions suggest that Bitcoin may reach upwards of $100,000 within the next few years, while Ethereum could see significant advancements with Ethereum 2.0, enhancing its scalability and energy efficiency. Solana might continue to attract attention, potentially solidifying its position as a leading platform for dApps and DeFi.Key developments expected include Bitcoin integrating more institutional investments, Ethereum enhancing its ecosystem through upgrades, and Solana expanding its network of partnerships.

Regulatory impacts will also shape the landscape, as governments worldwide grapple with how to manage cryptocurrencies.

Community and Ecosystem Development

The community support behind Bitcoin, Ethereum, and Solana has been pivotal for their growth. Bitcoin's community is rooted in its ideological foundation of decentralization, while Ethereum has fostered a vibrant developer ecosystem that continuously builds innovative projects. Solana's community has quickly grown, rallying around its scalable and efficient platform.Developers play a crucial role by creating projects that utilize these cryptocurrencies.

Successful applications include Ethereum-based DeFi platforms like Uniswap and Aave, and Solana's fast-growing NFT marketplaces like Solanart. Each cryptocurrency's ecosystem reflects its unique strengths and community engagement.

Comparative Analysis of Use Cases

Bitcoin, Ethereum, and Solana serve different purposes in real-world applications. Bitcoin is primarily used for value storage and peer-to-peer transactions. Ethereum facilitates a wide range of decentralized applications and smart contracts, making it a versatile platform for innovation. Solana excels in speed and low transaction costs, ideal for high-frequency trading and DeFi applications.

| Cryptocurrency | Transaction Speed | Average Fees | Use Cases |

|---|---|---|---|

| Bitcoin | 7 transactions per second | $2-3 | Store of value, peer-to-peer transactions |

| Ethereum | 30 transactions per second | $5-15 | Smart contracts, dApps, DeFi |

| Solana | 65,000 transactions per second | $0.00025 | High-speed trading, DeFi, NFTs |

Societal and Economic Impact

The adoption of Bitcoin, Ethereum, and Solana has profound societal implications. These cryptocurrencies promote financial inclusion, offering unbanked populations access to digital finance. In regions with unstable currencies, cryptocurrencies provide a viable alternative for conducting transactions. Countries like El Salvador have embraced Bitcoin as legal tender, demonstrating the potential of cryptocurrencies to reshape economic systems. Ethereum's applications in health, finance, and governance showcase its versatility, while Solana is making strides in streamlining transaction processes across various sectors.

The societal shift towards cryptocurrency signifies a new era in economic interaction and empowerment.

Summary

In summary, the bitcoin ethereum solana prognose reveals a complex but fascinating interplay of technology, investment potential, and societal impact. As these cryptocurrencies continue to evolve, staying informed about their developments is crucial for anyone interested in the future of finance. With ongoing innovations and market trends, the journey ahead promises to be exciting and full of opportunities.

FAQ Overview

What are the key differences between Bitcoin, Ethereum, and Solana?

Bitcoin primarily serves as a digital currency, Ethereum is known for its smart contract functionality, while Solana focuses on high transaction speeds and scalability.

Which cryptocurrency has the highest market cap?

As of now, Bitcoin holds the highest market cap among cryptocurrencies, followed by Ethereum and then Solana.

What factors influence the price of these cryptocurrencies?

Price influences include market demand, technological advancements, regulatory news, and investor sentiment.

Are there risks in investing in these cryptocurrencies?

Yes, investing in cryptocurrencies involves risks such as market volatility, regulatory changes, and technological vulnerabilities.

What is the future outlook for Bitcoin, Ethereum, and Solana?

The future outlook varies; Bitcoin is seen as a store of value, Ethereum could grow with DeFi applications, and Solana's scalability might enhance its utility in high-speed transactions.